Business News

At current rates, oil and gas companies will prevent world from hitting 1.5°C warming goal

Jul 22 2021

The most comprehensive study of the oil and gas industry’s performance against the Paris climate goals today shows that, without immediate and decisive action, the sector would prevent the world from meeting the IPCC’s 1.5°C global warming scenario by 2050.

The benchmark from the World Benchmarking Alliance (WBA), alongside partners CDP and ADEME, scores private, state-owned and publicly listed companies using CDP’s and ADEME’s Assessing low Carbon Transmission (ACT) methodology. This is the first time the industry has been judged against a 1.5°C scenario - the most ambitious emissions reduction plan proposed by the Paris Agreement - and the first study to assess oil and gas companies using the International Energy Agency’s (IEA) Net Zero Emissions by 2050 scenario.

Assessing 100 of the world’s biggest oil and gas firms against this scenario, it shows that based on current rates of production these companies are set to consume the sector’s allocated carbon budget (from 2019 to 2050) by 2037 - 13 years too early. Despite this trajectory, researchers found that none of the 100 companies have committed to stopping exploration. Other key findings include:

- From 2014-2019 the majors and National Oil Companies (NOCs) all increased either their oil or gas production.

- Only 13 companies have low carbon transition plans that extend at least 20 years into the future.

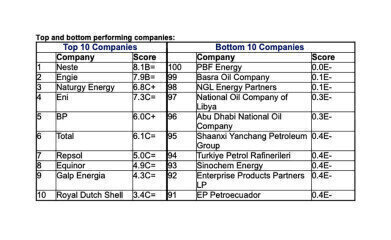

- The top 10 companies in the ranking all come from Europe.

State owned companies emerge as the ones that hold significant influence, but are severely lacking in corrective action, eating into the IEA’s remaining overall carbon budget (for all sectors). Oil and gas extracted by the 100 companies assessed is set to use up nearly 80% of the remaining CO2 budget for all sectors and all human activities. State-owned companies will take up half the remaining carbon budget (54%). The seven oil majors (BP, Chevron, ConocoPhillips, Eni, ExxonMobil, Shell and Total Energies) account for a further 13%, and independent companies 12%.

Sector marked by lack of ambition and action

Opaque, unambitious or non-existent targets and strategies from the greatest contributors to climate change show that the oil and gas sector is not accepting its share of responsibility for global emissions. Some companies’ scope 3 emissions are equivalent to the emissions of whole countries, for example ExxonMobil’s scope 3 emissions in 2019 were greater than Canada’s. Also in 2019, Saudi Aramco’s scope 1, 2 and 3 emissions were greater than Germany, France, Italy and Spain’s combined emissions.

There is also an overall lack of comprehensive and comparable climate reporting in the sector. Crucial gaps include emissions data, with most companies sharing only partial data across scope 1 and 2. Only a third of the companies, including Galp, Repsol & Equinor, disclose information on scope 3 emissions.

Research & Development (R&D) is another area where companies are yet to show action, despite many referencing “new technologies” as the future of the industry in their transition plans. While more than half of those assessed have disclosed R&D expenditure, only 17 companies report information on the proportion of investment dedicated to low-carbon technologies in 2019. Worryingly, even fewer (just 12) publish information on low-carbon capital expenditure investment plans to 2024 and these planned investments remain too low to enable a shift to a low-carbon world.

Digital Edition

AET 28.2 April/May 2024

May 2024

Business News - Teledyne Marine expands with the acquisition of Valeport - Signal partners with gas analysis experts in Korea Air Monitoring - Continuous Fine Particulate Emission Monitor...

View all digital editions

Events

Jul 30 2024 Jakarta, Indonesia

China Energy Summit & Exhibition

Jul 31 2024 Beijing, China

2024 Beijing International Coal & Mining Exhibition

Aug 07 2024 Beijing, China

IWA World Water Congress & Exhibition

Aug 11 2024 Toronto, Canada

Aug 25 2024 Stockholm, Sweden and online

.jpg)